Purchases During The Month

This month I added 28 shares to my position in Deere & Company at the price of 85.50 dollars. The company is currently trading at 9.88 times the last four quarters earnings.

The reason for the low valuation is that Deere & Co has a cyclical buisness and is dependent on economic conditions in the agricultural sector.

The company has had its record year in 2013, and my guess is that last year was the peak of this cycle. However, this doesn't deterrent me since Deere & Co (DE) is a qualitative and established company. I believe that DE will continue to grow over it's dividend the coming years.

The the dividend payout ratio based on EPS (TTM) is a low 27.4% at the moment. You can read more about the purchase here: http://long-terminvest.blogspot.se/2014/11/recent-buy.html

Development of Our Passive Income

After purchasing Deere & Co the portfolio yield increased slightly and yield of cost is at the present time 4.83%.

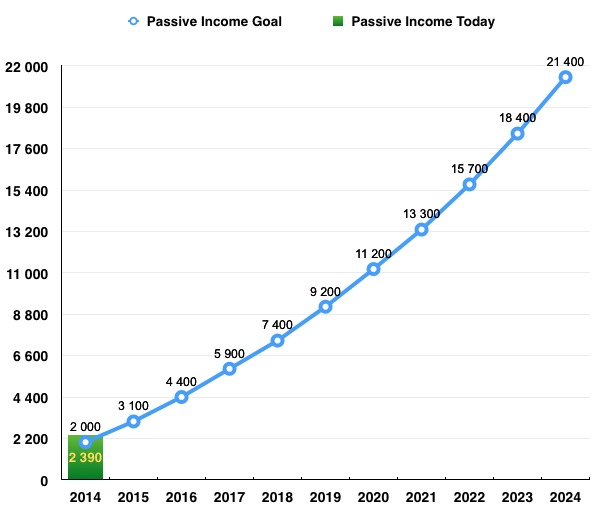

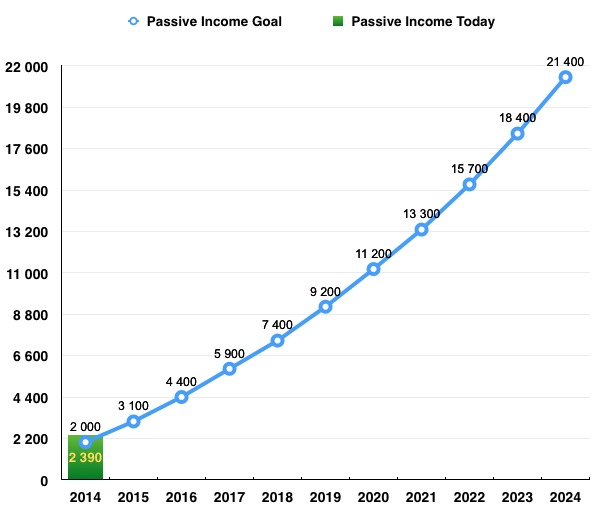

The passive income is, when I write this, approximately 2 390 dollars annually, covering about 4.8% of our annual living costs. This is how our passive income has developed relative to the first 10 years of our long-term savings goals:

The diagram above shows that we already have reached and passed the target for 2014, with one month left of the year. Provided that nothing catastrophic happens, it looks like we are in a good place heading into next year. There is still a long way go though until our passive income reaches awe-inspiring levels.

The diagram above shows that we already have reached and passed the target for 2014, with one month left of the year. Provided that nothing catastrophic happens, it looks like we are in a good place heading into next year. There is still a long way go though until our passive income reaches awe-inspiring levels.

The blog

During the month of October the blog had about 3 000 page views, totaling around 3 300 since its inception this month. Not that many page views compare to my Swedish blogg, but it's nice that people are starting to finding the blog.

The Month ahead

In November, almost all the companies on my watchlist became more expensive. The only company that looks cheap at the moment is Bonheur, but the uncertainty is much greater there than for other companies.

Development of Our Passive Income

After purchasing Deere & Co the portfolio yield increased slightly and yield of cost is at the present time 4.83%.

The passive income is, when I write this, approximately 2 390 dollars annually, covering about 4.8% of our annual living costs. This is how our passive income has developed relative to the first 10 years of our long-term savings goals:

The blog

During the month of October the blog had about 3 000 page views, totaling around 3 300 since its inception this month. Not that many page views compare to my Swedish blogg, but it's nice that people are starting to finding the blog.

The Month ahead

In November, almost all the companies on my watchlist became more expensive. The only company that looks cheap at the moment is Bonheur, but the uncertainty is much greater there than for other companies.

My appreciation of sustainable EPS and future dividend growth for Bonheur is dependent of how the price of oil develops and the condition of the company's fleet. I will postpone any purchase decision, partly because the company already accounts for a significant portion of the portfolio and partly because I want to see how Fred Ohlsen (FOE) and other business segments develops in the future. I will describe the company in greater detail in coming posts.

Congrats on the passive income, LTI. Looks like you are well past your goal for the year. Congrat on that achievement as well.

ReplyDeleteR2R

Thanks! Things are looking good at the moment. I'm holding my fingers crossed that buying opportunities will surface in December.

ReplyDeleteOil climbs from three-month low as more oil workers strike in Norway.

ReplyDeleteCapitalstars