For those of you that are not familiar with the company, BHP Billiton is the world's largest diversified resource company. The Company is engaged in the exploration, development, processing and production of a number of minerals and raw materials. The company also has oil and gas operations.

BHP Billiton is cyclical and profitability is dependent on the price of the raw materials that the company extracts and refines - mainly iron ore.

I tend to be restrictive when it comes to energy companies since they are dependent on the underlying commodity and the fact that it is difficult to create competitive advantages in the industry. However, I am willing to make exception in this case because of the following qualities I associate with BHP Billiton:

- BHP Billiton has one of the lowest production costs per tonne of iron ore by virtue of its efficient facilities in Australia.

- The company has the most diversified commodity portfolio in the industry.

- The balance sheet is among the strongest in the sector.

These qualities make the company well equipped to cope with a further decline in commodity prices, mainly iron ore. BHP Billiton's dependence on commodity prices and the lack of a wide moat means that the price is important.

Valuation

The price I paid is the below my Price Cap of $43 dollars. My Price Cap is based on the following assumptions:

- I estimate that BHP Billiton will have an average dividend growth rate equivalent to about 3% going forward.

- I deem sustainable EPS to be roughly 5 dollars and sustainable P/E-Ratio to be 11.

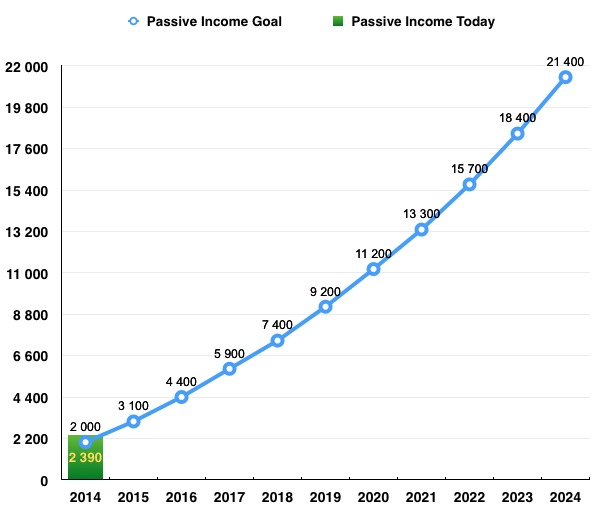

After the purchase our passive income is approximately 2340 dollars on a annual basis. You can find my latest portfolio allocation in the main menu. I plan, in a not to distant future, to post a longer analysis about BHP Billiton Plc. Until then have ha nice day!